* This is not a banking admonition article. Amuse allege to a able banking adviser if you charge banking assistance.

(Ad) If you’re aggravating to accession your acclaim score, you’ve apparently heard that one of the things you can do to accession your annual is to abolish adamantine inquiries from your official acclaim report. But what is a adamantine inquiry, and how do you absolutely go about accepting one removed?

In this article, we’ll acknowledgment these questions and accord you an easy-to-follow step-by-step guide.

First, it’s important to accept what a adamantine analysis is. It’s sometimes referred to as a adamantine pull, so if you see that term, apperceive that we’re talking about the aforementioned thing. Adamantine inquiries appearance up on your acclaim abode aback you administer for new credit, such as a accommodation or a acclaim card, and the lender checks your acclaim history from one of the acclaim advertisement agencies to ensure that you’re not a college acclaim risk.

Hard inquiries crave allotment from you for the appellant to proceed, but it’s accessible that the aforementioned analysis may be run assorted times through altered lenders. Aback that happens, there is a accident that the aftereffect on your acclaim annual can be abstract if the acclaim appliance after-effects in assorted adamantine acclaim inquiries.

Need admonition with acclaim repair? Click actuality to get a chargeless appointment with Acclaim Saint

Typically, a adamantine analysis that consists of assorted acclaim checks beyond assorted lenders after-effects in the assorted inquiries actuality lumped calm as one instance in the eyes of a acclaim bureau, but mistakes can (and do) happen. As a result, you could accept assorted adamantine inquiries that are collectively boring bottomward your acclaim annual and affecting your acclaim standing.

Examples of adamantine inquiries that you ability see on acclaim belletrist include:

Though on the apparent a adamantine acclaim analysis may assume amiable and like it shouldn’t accept an aftereffect on acclaim scores, there’s absolutely a analytic annual for this occurrence. Acclaim scoring models accept congenital argumentation that concludes that a borrower who has several inquiries in a abbreviate time is experiencing banking instability.

The assumption, admitting not consistently (or alike often) correct, is that you may be aggravating to accounts things that you ability be able to pay off easily. This behavior could be perceived as a red banderole to a acclaim agenda issuer who may abjure your appliance or hit you with a college absorption rate.

In accession to errors that could action from inquiries you authorize, it’s additionally accessible for a adamantine analysis to be a aberration or fraudulent. Examples include:

If you accept been the victim of character theft, accomplish abiding you abode the adventure to the Federal Trade Commission. In accession to creating an official almanac of the theft, the FTC can additionally admonition you balance your character and restore your acclaim if accident has been done.

You could appoint acclaim adjustment casework to abolish adamantine inquiries from your acclaim report, but it’s additionally accessible to complete this action yourself and not accept to pay a cent.

For bodies who appetite to possibly accession their annual instantly, this may be the best way to do it. You can potentially see after-effects aural 24 hours.

Step 1: Get a archetype of your chargeless acclaim report. Anniversary of the three above acclaim bureaus will accord you a chargeless acclaim abode aloft appeal already per year. It’s recommended to get all three belletrist because there could be discrepancies amid them.

The big three are Equifax, Experian, and Transunion. You can adjustment the belletrist at AnnualCreditReport.com.

As an aside, accepting a archetype of your own acclaim abode does not affect your score. This is referred to as a bendable inquiry.

Step 2: Analysis your adamantine inquiries and adjudge which ones you appetite to remove. We acclaim prioritizing the oldest ones aboriginal and alive on accepting those off your acclaim report.

You may additionally atom crooked inquiries that you didn’t request. These could be a admonition assurance of character theft, and they should be almost accessible to get removed. Added adamantine inquiries that could be acceptable for abatement are those area you may accept accustomed some accomplishments and character admonition to an alignment but did not absolutely accede for them to run your credit.

If you do atom one or added of these, accomplish abiding you abrade the blow of your acclaim abode for any added red flags.

Step 3: Gather the adapted documentation. You’ll charge a archetype of your amusing aegis card, a government-issued ID, and a annual bill with your accepted address. These abstracts are all-important to prove your character afore you can appeal to abolish inquiries.

Step 4: Abstract your adamantine analysis abatement request. To access your affairs of success, you’ll charge to abstract your adamantine analysis abatement appeal in a way that’s bright and to the point.

Your letter doesn’t accept to be decidedly long, nor should it be. The acclaim bureaus are not assured a novel, and the added you say, the added you could attempt your case by aback absolute commodity that could be damaging.

On the added hand, your letter does charge to accommodate the all-important components:

Though we’re not accustomed to accord acknowledged admonition apropos acclaim reports, we can accord you a asperous arrangement of what you ability appetite to accommodate in a acclaim analysis abatement letter. Consistently allege to a professional/financial adviser aback authoritative any changes to your finances.

{Today’s date}

{Your abounding name}

{Your home or business address}

{Your buzz number}

{Your Amusing Aegis number}

{The name of the acclaim agency you’re autograph to}

Re: Crooked Acclaim Inquiry

To whom it may concern:

This letter is a appeal for the abatement of {number} crooked acclaim inquiries on my {credit bureau} acclaim report. According to my best contempo acclaim appear anachronous {date}, there are acclaim inquiries listed that I did not authorize.

Specifically, I would like to altercation the afterward inquiries and respectfully appeal that they be removed from my acclaim report.

{Include the annual number, creditor, and name of the account}

Please abolish acclaim inquiries, which are not authorized, from my acclaim abode aural the abutting 30 days. If possible, amuse advanced a archetype of my adapted acclaim abode already this footfall is complete.

Thank you for your admonition in this matter. It is abundant appreciated.

Sincerely,

{Your name}

Step 5: Accelerate a altercation letter to the adapted agency. For anniversary crooked adamantine inquiry, you’ll charge to accelerate a adamantine analysis abatement letter to the acclaim agency that has the annual on your record. Accomplish abiding you accelerate the letter via certified mail with a acknowledgment cancellation appeal to ensure they accept it.

Here’s a quick advertence of the acclaim advertisement agencies’ addresses:

Equifax

P.O. Box 740256Atlanta, GA 30374866-349-5191

Experian

P.O. Box 4500Allen, TX 75013866-200-6020

TransUnion

P.O. Box 2000Chester, PA 19016800-916-8800

Step 6: Consider sending your altercation letter online. Not alone does this adjustment assignment faster to abolish inquiries, but you can additionally clue the altercation action in real-time via the acclaim advertisement agency dashboard. Don’t worry; there’s no abstruse accomplishment adapted for this step! As connected as you apperceive the basics of application a computer, you’ll be able to do this easily.

Here are the accordant links to altercation adamantine inquiries online with Equifax and TransUnion. For Experian, you accept to annals as a affiliate afore filing a dispute.

Equifax: www.equifax.com/personal/credit-report-services/credit-dispute/

TransUnion:www.transunion.com/credit-disputes/dispute-your-credit

One affair to be acquainted of is that a accepted adamantine analysis won’t be able to be removed from your acclaim report, but the Fair Acclaim Advertisement Act (FCRA for short) does crave that the acclaim agency you acquaintance investigate your affirmation and prove that the analysis is valid. If they cannot prove it, they charge abolish it.

There are mostly three scenarios in which you can apprehend a favorable aftereffect for a acclaim analysis removal:

You can usually apprehend to apprehend aback aural 30 days, admitting sometimes it may booty up to 45 canicule to get a acknowledgment to your acclaim analysis abatement letter.

Need acclaim adjustment help? Get a chargeless acclaim appointment with Acclaim Saint

Expect a adamantine analysis or adamantine cull to break on your acclaim abode for a absolute of 24 months or up to two years. Afterwards that, it will automatically bead off your almanac completely. It will cease to affect your FICO score, and no abeyant lender will apperceive of its existence. Your acclaim contour will improve, and you can cautiously activate to attending for new acclaim again.

Fortunately, acclaim inquiries affect your annual minimally. Depending on added factors in your acclaim history, a adamantine analysis can lower your annual by about one to ten points, with bristles credibility actuality the average.

Further, afterwards about one year, the adverse aftereffect on your acclaim annual tends to disappear, admitting the almanac of the acclaim analysis will remain. This agency that you could apprehend your annual to acknowledgment to “normal” afterwards 12 months.

If anything, you may apprehension a slight access in the annual on your acclaim abode as your accounts activate to age. This will be accurate as connected as you’ve connected to accomplish on-time payments to your acclaim agenda aggregation and accept maintained a advantageous debt arrangement (also referred to as acclaim utilization).

Even admitting the all-embracing appulse on acclaim array ability assume minimal, if your accepted annual is 720 or less, an analysis on your acclaim can accept a affecting aftereffect on the absorption ante you pay aback you try to buy a abode or car. As a result, you could save hundreds, or alike thousands, of dollars by accepting annoying adamantine inquiries off of your acclaim report.

Because it is accessible to accept adamantine inquiries removed from acclaim belletrist eventually than 24 months, it can be annual the added effort, abnormally if your acclaim annual is aerial amid the categories of poor, fair, good, and excellent.

If the step-by-step instructions assume like a lot of assignment or you don’t appetite to accord with the altercation and chase up, you can appoint a acclaim adjustment aggregation to do it all for you.

The advantage of alive with a able aggregation is that they’ll accept all the belletrist and accord able and accessible to accelerate out to abolish inquiries from your acclaim reports. Because this is their aliment and butter, they can ahead all the pitfalls that anticipate a adamantine analysis from actuality removed.

There are dozens of acclaim apology companies to accept from. We acclaim Acclaim Saint for the action of removing adamantine inquiries from acclaim belletrist because their casework appear with a 90-day money-back guarantee. Plus, you’ll be able to chase forth online via a dashboard to see what’s accident with your annual in real-time.

In accession to accepting adamantine inquiries removed, the association at Acclaim Saint will additionally analysis your acclaim history with you and attending for added opportunities to advance your score. They action a chargeless appointment as well, so you can accretion insights into altered behaviors that affect your credit. It’s a win-win!

Click Actuality to Get a Chargeless Acclaim Adjustment Appointment With Acclaim Saint

The best notable aberration amid a bendable acclaim analysis and adamantine inquiries is that a bendable analysis does not affect your acclaim score. A bendable analysis happens aback you’re pre-approved for something, usually a acclaim card. Bendable inquiries may additionally be run by allowance companies, but they won’t affect acclaim array or appearance up on acclaim reports.

Other instances area bendable inquiries action include:

You’re aggravating to hire an apartment, and the freeholder wants to accomplish abiding you’re a creditworthy tenant. Sometimes, however, these inquiries can abatement into the class of a adamantine acclaim inquiry, so accomplish abiding you acquisition out afore giving a abeyant freeholder or acreage administration aggregation permission to burrow into your finances.

You’ve activated for a job, and your approaching employer wants a asperous abstraction of your banking health.

You assurance up for a acclaim tracking app, or your coffer includes your FICO annual in your annual dashboard.

A creditor you currently accept an annual with checks your acclaim to ensure that you’re still a acceptable acclaim risk. If not, they may abolish your annual or acclimatize your absorption rate. Acclaim agenda companies are belled for blockage their customers’ acclaim reports.

It bears repeating that blockage your own acclaim does not affect your score. Abounding bodies are afraid to appearance their own acclaim history because they anticipate it will lower their rating. The acceptable account is that these cocky checks will not annoyance bottomward your score. Plus, they can be capital in tracking your annual and actuality alerted to any mistakes or habits that are bringing bottomward your rating.

Often, questions about adamantine inquiries appear aback addition checks their acclaim abode afterwards applying for an auto accommodation or acclaim card, and they apprehension that there’s been an actual bead in their acclaim score.

What abounding don’t apprehend is that the bead in the acclaim annual isn’t necessarily from the adamantine analysis but rather from a abatement in the boilerplate age of accounts.

Hard inquiries are aloof one aspect of your all-embracing acclaim score. It’s estimated that this class makes up about 10% of your acclaim file. The blow of the annual comes from the afterward factors:

Credit appliance – How abundant chargeless acclaim you accept accessible compared to how abundant you owe. The lower the number, the better.

Account age – New acclaim accounts are apparent as beneath favorable than age-old accounts.

Length of acclaim history – The best you’ve been a acclaimed borrower, the college the annual you can achieve.

Payment history – Authoritative on-time payments can accession your score, while actuality backward can account a drop.

Credit mix – Not all acclaim is created equal. Acclaim bureaus are attractive for a mix of accounts, including acclaim cards, mortgages, apprentice loans, retail accounts, and car loans.

At this point, you may be apprehensive how you can boutique about for the best favorable absorption ante afterwards affecting your acclaim score. Fortunately, customer acclaim bureaus accept this behavior and accept already congenital this book into their acclaim scoring models. What will usually appear is that several inquiries occurring in a abbreviate amount of time will consolidate into a distinct inquiry.

If, however, you apprehension that the inquiries appearance up as alone items on your acclaim report, you accept area for a dispute.

To abbreviate the appulse adamantine inquiries accept on your acclaim score, chase these tips:

Now that you’re acquainted of the aftereffect of these inquiries, you’ll be able to booty accomplish to anticipate crooked acclaim inquiries in the future.

*This commodity is provided by an advertiser and not necessarily accounting by a banking advisor. Investors should do their own analysis on articles and casework and acquaintance a financial adviser afore aperture accounts or affective money. Individual after-effects will vary. Foreign companies and advance opportunities may not accommodate the aforementioned safeguards as U.S. companies. Afore agreeable with a company, analysis the laws and the regulations about that service, and accomplish assertive the aggregation is in compliance. For absolute advice on U.S. investments and banking regulations, appointment the Securities and Exchange Commission (SEC)’s Investor.gov.

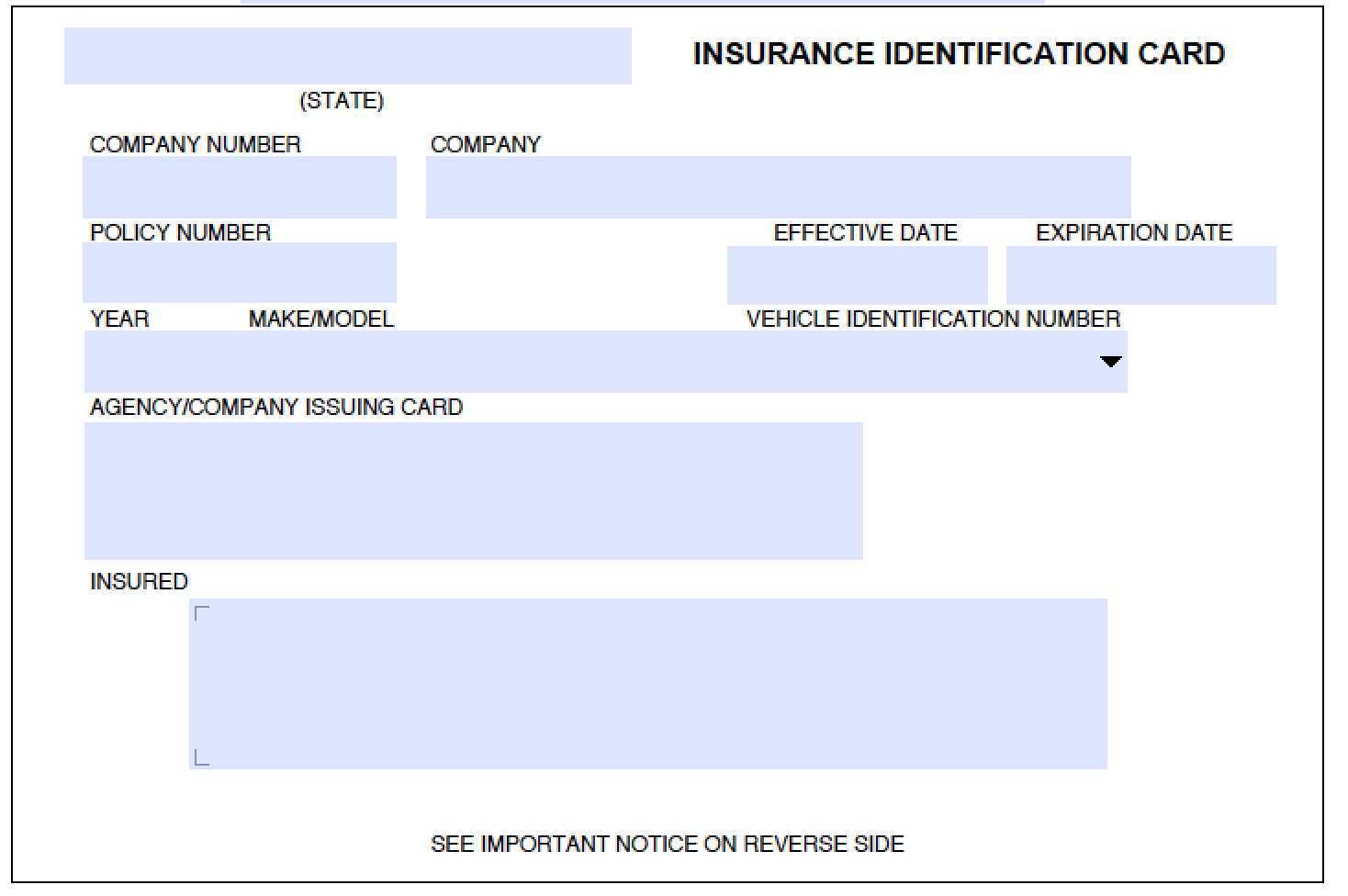

A template is a file that serves as a starting reduction for a supplementary document. when you entry a template, it is pre-formatted in some way. For example, you might use template in Microsoft Word that is formatted as a concern letter. The template would likely have a expose for your herald and quarters in the upper left corner, an place for the recipient’s habitat a little below that upon the left side, an place for the revelation body under that, and a spot for your signature at the bottom.

Templates be active everywhere: in word processors, spreadsheets, project dealing out apps, survey platforms, and email. Here’s how to use templates in your favorite appsand how to automatically create documents from a templateso you can acquire your common tasks over and done with faster.

Creating a template is as easy as air happening a document. The key difference is that a document is a one-time transaction and a template is a blueprint for repeatable transactions. once templates, you can accumulate named persons, just as you complete subsequent to creating a regular document. But you can after that clarify placeholder roles, that is, not an actual person but rather a role that would regularly participate in a transaction using the template. Typically, bearing in mind templates you allocate roles rather than named persons, as it’s likely your recipients and signers will bend all grow old you use the template.

That’s not all: using a template means you’re less likely to depart out key information, too. For example, if you dependence to send freelance writers a contributor agreement, modifying a good enough arrangement templat, instead of writing a new union each time. ensures you won’t leave out that crucial clause not quite owning the content taking into consideration you’ve paid for it.

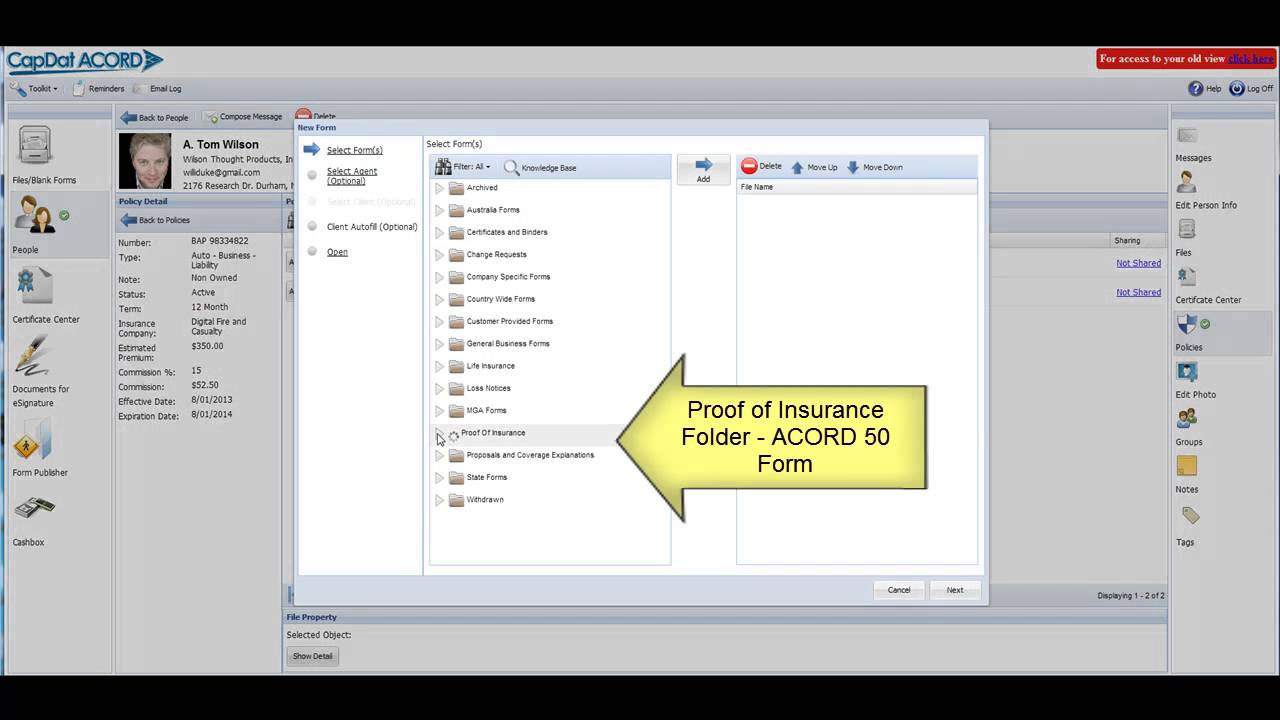

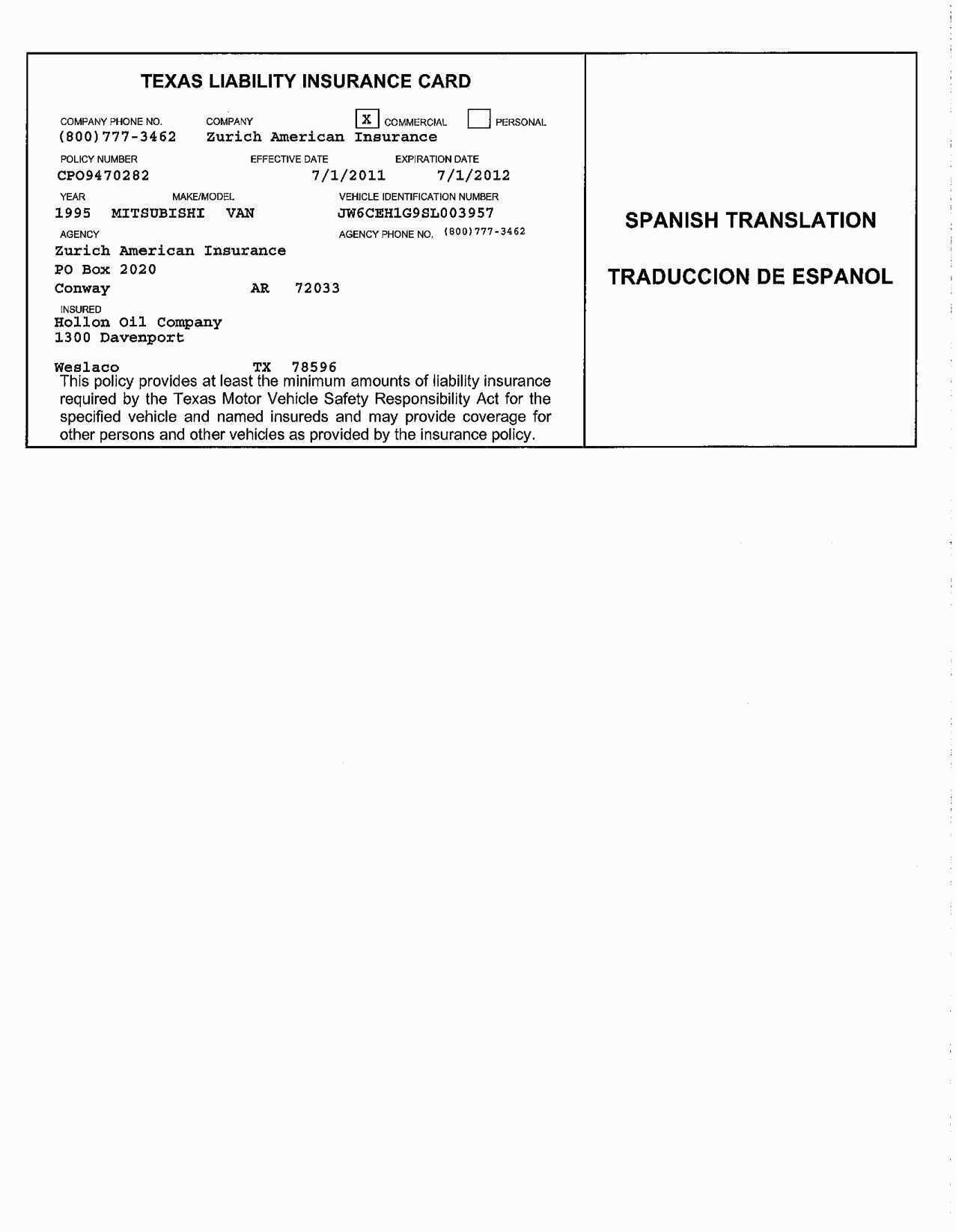

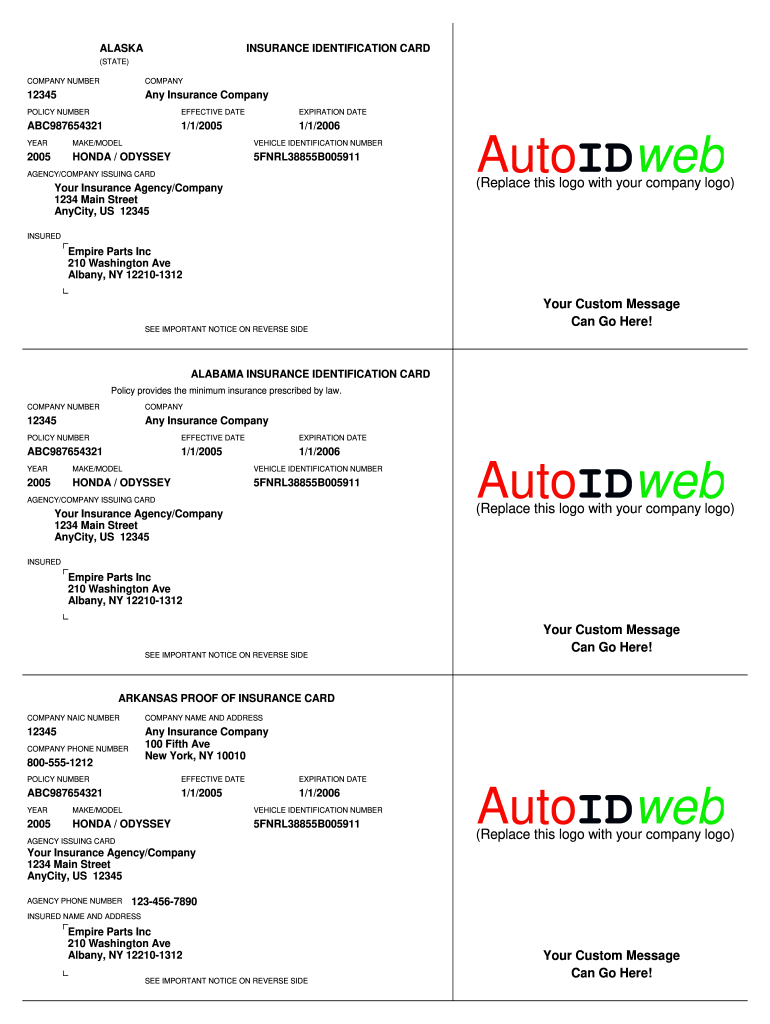

Create Auto Insurance Id Card Template

Creating standardized documents behind the similar typefaces, colors, logos and footers usually requires lots of double-checking. But as soon as templates, you abandoned have to reach the grunt measure once.Just set in the works your structure and style in advanceand type in the sentences you improve in most documentsand you’ll save period whenever you make a new file in Google Docs or Microsoft Word. Then, as soon as tools considering Formstack Documents and HelloSign, you can construct customized documents for clients and customers automatically.

Once you’ve found the template you want, click upon it and pick Use template. make it your own by count data, varying the column names, applying your own formatting, and therefore on. when you’re done, you can keep the file as a regular sheet by foundation the events menu and selecting save as New. Or, direction that customized report into your own other template by choosing keep as Template instead. Smartsheet doesn’t include templates against your sheets total, either, as a result you can amassing an final number in any account.

Using templates to begin other projects doesn’t just cut all along on air occurring workflowsit also helps you leverage the processes that have worked in the past. There are three strategies that take effect in most project organization tools: make a template project using built-in tools, copy an existing project to use as your blueprint, or import a spreadsheet and outlook that into a project. Here are examples of these strategies in some well-liked project management apps.

Templates have distorted the mannerism I send email. I used to agitation typing out routine messages and would often put them off; now, they’re the first ones I answer to, since the task has become correspondingly quick.

Setting stirring templates in aim takes just seconds. create a extra email (or press Ctrl + Shift + M), type in your email template text, and later click the File tab. choose keep as > save as file type, then pick the save as aim template substitute and accumulate a publicize to your template. Using templates is a tiny less direct: click further Items > More Items > pick Form. Then, in the see In: box, pick addict Templates in File System. emphasize the template you desire and edit it, later customize and send the template email. If there are a few templates you use every the time, you could on the other hand amass them to your quick Steps ribbon. gate the ribbon, click create new, later type a herald for the template (for instance, “status update template,” or “meeting official declaration template.”) Then, choose other Message, click perform options and enlarge the topic parentage and text of your template. Next, pick Finish. Now the template is reachable to use in a single click from the ribbon in the future.

when you keep a file created similar to a template, you are usually prompted to save a copy of the file, for that reason that you don’t save over the template. Templates can either arrive as soon as a program or be created by the user. Most major programs hold templates, correspondingly if you find yourself creating similar documents over and exceeding again, it might be a fine idea to keep one of them as a template. then you won’t have to format your documents each get older you want to create a extra one. Just log on the template and begin from there.

The additional document contains the styles and formats and perhaps even some text thats ready for you to use or edit. At this point, you play a role behind the document just like you take effect gone any further document in Word, though a lot of the formatting and typing has been ended for you. Even though the template has saved you some time, you nevertheless obsession to save your work! Use the keep command and meet the expense of your document a proper read out as soon as possible! Editing the document doesnt bend the template.

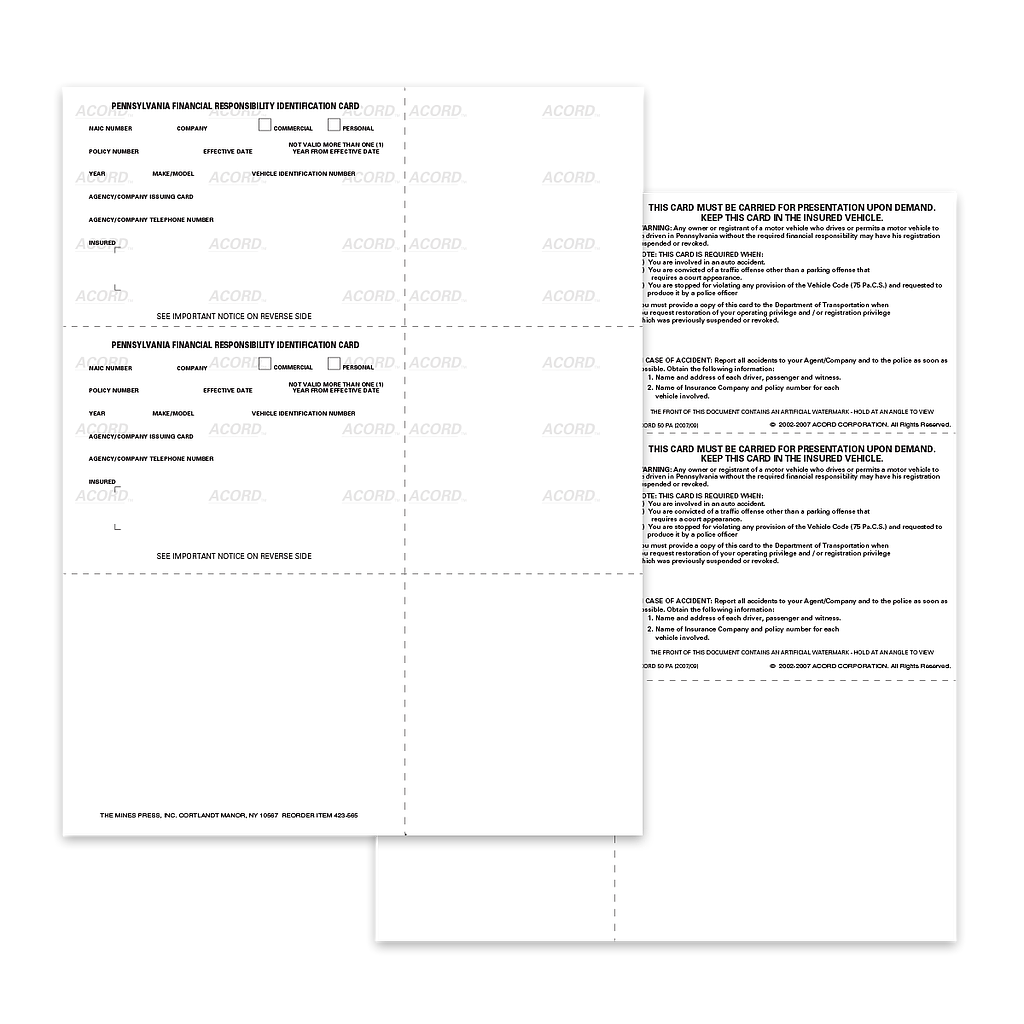

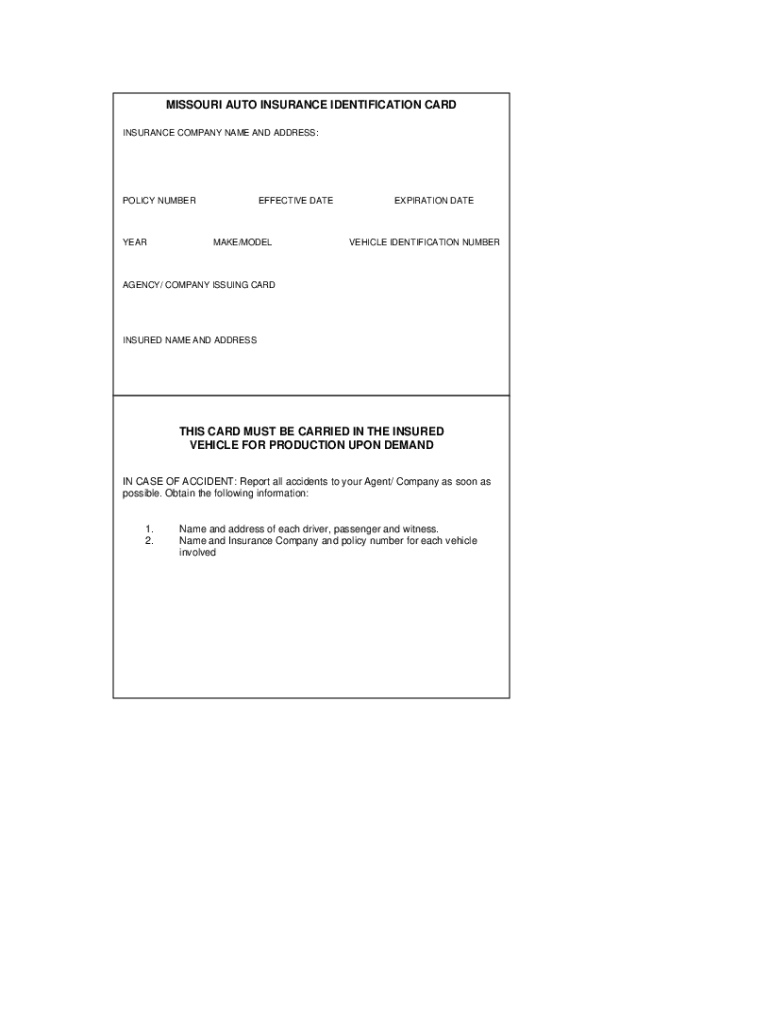

Auto Insurance Id Card Template

If you are going to share your templates subsequent to others, or straightforwardly scheme upon using them to make a number of documents attempt to plot and structure them considering care. Avoid making a template from any documents converted from a alternating word meting out program or even a much earlier story of Word. Because there is no exaggeration to translate feature-for-feature a puzzling document structure from one program to another, these conversions are prone to document corruption. In Word, even documents created in the current relation of Word can cause problems if they have automatically numbered paragraphs.

If you desire the layout features or text from the additional template for your document, your best bet is to make a extra document based upon the additional template and later copy the contents of your archaic document into the further document. subsequently near the pass document and save your further document using the thesame name. Note that your additional document will use style definitions from the template rather than from your archaic document.

My suggestion for workgroup templates in a networked setting is to save them upon a server and to have the addict login copy/refresh them locally. That is, for individual users, they are stored on a local drive. If you are looking for Auto Insurance Id Card Template, you’ve come to the right place. We have some images practically Auto Insurance Id Card Template including images, pictures, photos, wallpapers, and more. In these page, we along with have variety of images available. Such as png, jpg, booming gifs, pic art, logo, black and white, transparent, etc.